Most lenders lose ~80% of their recapture opportunities.

.png?width=485&height=323&name=Wednesday%20(1).png)

Why a Refi Recapture Engine?

You invest in nurture and engagement tools for your LOs, yet ~80% borrowers choose another lender or their servicer for a refi.

Why wasn't your LO their first choice?

Borrowers use the lender who provides relevant and actionable loan information, not the one who sent the most emails.

That's where we come in.

2026 will be the year of recapture wars.

Our Refi Recapture Engine levels the playing field.

Purpose-built for lenders.

The moment a borrower becomes refi-ready is invisible without constant analysis. Today, that analysis and high-value borrower communication are manual and time-consuming.

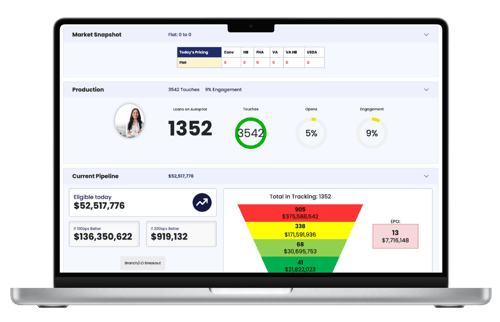

The always-on engine runs in the background to analyze every loan in your database, produce and ship personalized quotes to borrowers, and deliver refi-ready borrowers directly to your LOs.

- "Right now" refi opportunities

- Near-instant path to ROI

- Fast, no IT implementation

- Monitors & alerts to EPO Risk

- Low, record-based pricing model

- Runs quotes daily for the entire database

- Pulls PPE data for accurate, real-time quotes

- Emails borrowers with a custom recommendation

- Empower your LOs to protect the relationships they've earned

- Retain the business you should be closing at a low acquisition cost

- Equip your sales leadership with predictable recapture forecasting tools