Most lenders lose ~80% of their recapture opportunities.

.png?width=485&height=323&name=Wednesday%20(1).png)

Recapture Loss is Staggering

You invest in nurture and engagement tools for your LOs, yet ~80% borrowers choose another lender or their servicer for a refi.

Why wasn't your LO their first choice?

Don't blame the nurture tools. Selling is not their job.

That's why we built a Recapture Engine.

2026 will be the year of recapture wars.

Our Refi Recapture Engine levels the playing field.

Purpose-built for lenders.

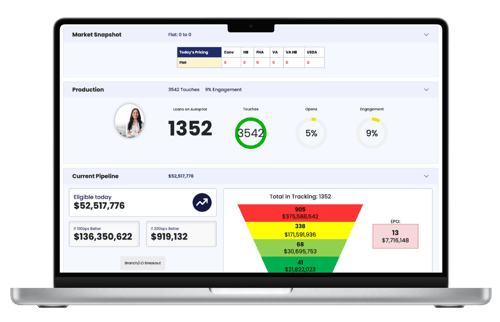

The always-on engine runs in the background to analyze every loan in your database, produce and ship personalized quotes to borrowers, and deliver refi-ready borrowers directly to your LOs.

- Pulls PPE data for real-time quotes

- Runs quotes daily for the entire database

- Emails every borrower with a recommendation

- Includes LO-branded borrower conversion platform

- Scores & flags borrower potential, including "not yet"

- Analytic & reporting dashboard for LO, branch, and corporate

The moment a borrower becomes refi-ready is invisible without constant analysis. Today, that analysis and high-value borrower communication are manual and time-consuming.

Protect the relationships you've earned.

Recapture the loans you should be closing.